Are you thinking about building accounting integrations for your ecommerce platform? Your customers have been demanding it, and you want to keep them happy, I get it. You might be tempted to build your own integration for QuickBooks or Xero. Let me tell you why you should think hard before starting on that journey.

Understanding product and technical limitations

First off, notice I didn’t just say “QuickBooks integration” in that first paragraph. While QuickBooks Online is the biggest platform, Xero is catching up quickly in the USA. And there are ten more right behind. Do you want to build and maintain multiple accounting integrations? Some new startup companies will tell you that they can give you one API to connect to all accounting platforms. It sounds like magic, doesn’t it? Wait until you find out you still need to know the accounting logic and capture all the dependencies and mappings before making that first post. Be sure to check that each type of post is available across all their target platforms; you might be surprised.

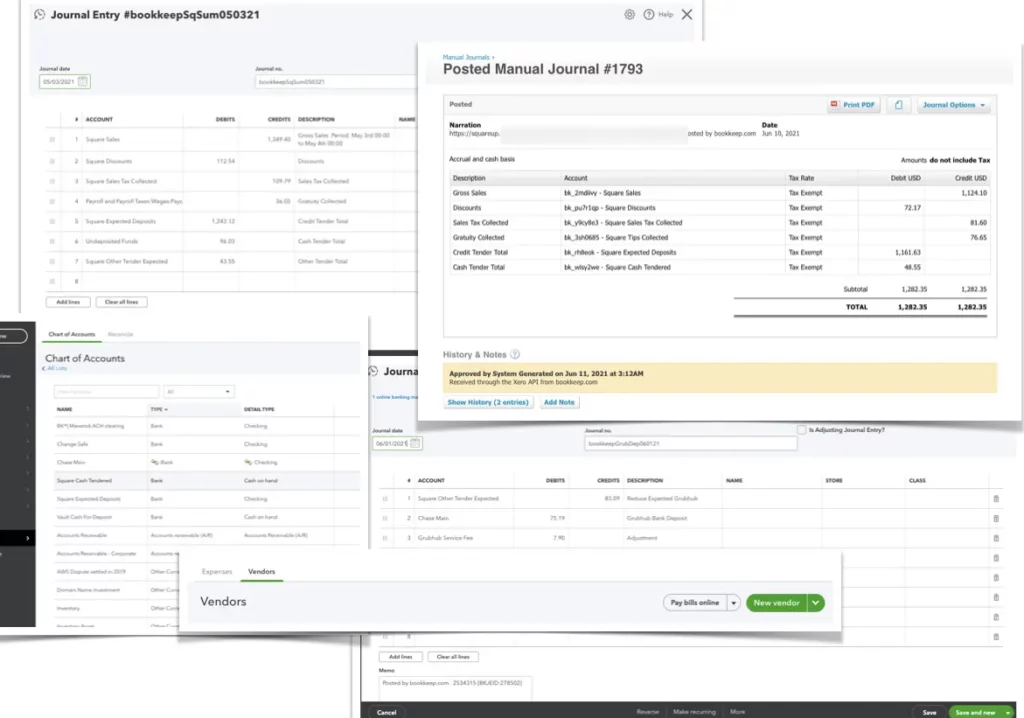

If you got this far and decide you still want to go ahead. Let’s talk about accounting logic. You post numbers to an accounting system in absolute or positive numbers. Accounting deals with increases and decreases using debits and credits. Debiting an asset account increases it and debiting a liability account decreases it. Does your product and engineering team know which is which?

In addition, the sum total of credits must equal the sum total of debits, so you better handle rounding issues properly, or postings will fail. This complexity is why almost every accounting integration only posts individual transactions instead of proper summarized GAAP compliant entries.

Posting sales transactions is the path of least resistance due to the complexity of summarized GAAP entries. But those transactions clutter the general ledger and will not match up (or reconcile) to payment deposits. That upsets the accounting community, trust me. Proper reconciliation is key to getting the books done each month, and if you are not solving this problem, you are just making it worse for the accountant.

Another ugly fact about accounting postings is the vast set of dependencies. An entry is not a single API call. First, you need to know the chart of accounts and account types. You will require the account mapping inputs from the user as well as classes, other reporting tags, vendors, and customers. That requires a user interface for a different type of user and multiple API calls to do a single post.

Solving customer care issues

So say you got this far and built your accounting integration. Is your customer care team ready to field questions from accountants? Do they understand debits and credits? Will they have visibility into the complex error messages from the accounting platform for why an entry failed? Will they know why the deposits the accountant sees in the bank feed don’t match the information your platform sent to the accounting system? Your care team is trained to support one type of customer, and now they have a new animal to contend with.

If you have ever built an accounting integration, you already know these problems and see it as a significant cost center. What about thinking of it as a revenue stream that also increases retention and gives you a competitive advantage for your product?

By partnering with bookkeep.com, you can have the best in class accounting integration to ALL accounting platforms with proper GAAP postings that make accountants smile. Bundle that with our 5-star customer care for an add-on feature customers will happily pay more for.

We talk to accountants and bookkeepers all day to automate their processes, solve their issues, and give them tools to bulk process postings across multiple commerce systems and multiple accounting platforms.

So, the next time someone in your company says, “we need to build a QuickBooks integration”, give us a shout to see how we can help.

For more information on how bookkeep can help, email [email protected]