If you are coding your books just based on the payout total you received, you are missing the bigger picture. Not only will your books be wrong (because the deposit doesn’t reflect the actual revenue and sales tax, etc), but you will not see the entire financial picture of all your sales and costs.

Also – the amount you received could cover up to four days of sales transactions in Shopify, based on GMT time zone (not your own time zone). This means you could be booking income and expenses into the wrong periods, as is the case with deposits that cross over different months.

Let’s take a look into what is hiding in your Shopify Payout total, and why you can’t accurately record revenue and fees, etc based on the payout report alone.

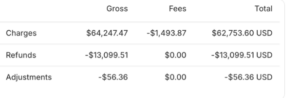

The Shopify Payout report shows Charges, Refunds, Adjustments and Fees. Let’s break each one down so you can see the things that are typically netted into those figures.

Charges, Gross

- Sales – This is the total sales that Shopify processed for you, for items you sold, during the period covered for the payout

- Sales Tax – the amount collected by Shopify on those sales

- Gratuities – received from customers

- Gift Cards issued – this is something you got money for, but actually isn’t sales

Fees –

- Shopify Payment Processing Fees

-

- Note that Shopify Platform fees come out separately each month and are typically not deducted from payouts.

Refunds

- Note – these are shown at GROSS, so they still need to be broken down into the Sale, the Sales Tax, and if there’s a Gratuity included that gets refunded as well.

Adjustments (Net)

- Adjustments (added):

-

-

- Channel Promotion Credits – eg. payments from Meta (for Facebook and Instagram coupons and incentives as example)

- Shop Cash Payments – these are added net of fees

- Shipping Label Adjustments – note that these can be added, or subtracted

-

- Adjustments (subtracted):

-

- Sales Tax withheld by Meta (or another marketplace) and remitted on your behalf

- Shop Cash Campaign Promotions – for each customer they bring to you, they take a certain dollar amount out of your deposits

- Chargebacks or Payment Disputes – these get subtracted from your net deposit. The annoying thing is that you can’t find which order it applies to – you just lose the money.

- Shopify Loan repayments – sometimes these come out of deposits, sometimes they are deducted separately, so you have to watch out for these

- Shipping Label Adjustments – note that these can be added, or subtracted

Net of all of the above, is the payout you received.

And it gets even more complicated because the Shopify Payout report does not include money coming in from Paypal, Shop Pay Installments, and other payment methods like Cash or Check.

Since you cannot accurately book accrual revenue and expenses based on your Payout Deposit reports, you’ll need to pull a number of reports in Shopify and use a spreadsheet to back into the Payout amounts.

Here are the steps to follow:

- In Shopify, go to Analytics > Reports > Summary

- Then, run the Summary for each day and generate a journal entry based off that report

- Enter the journal entry, booking the expected Shopify Payment amounts, as a debit to an asset clearing account.

- Then when the actual Shopify Payout is settled, use the asset clearing account to book the deposit amount as a credit (the other half of the entry will be a debit to cash).

- The two should net out to zero when taking into account the different time zones involved, and the fact that Shopify nets several sales days into each Payout.

- If it doesn’t net to zero, and you have factored in the time zone difference, it means you have an error in your calculations and will need to backtrack and check each figure.

Alternatively, you can choose to use an ecommerce and retail accounting automation software like Bookkeep. The advantage of using automation is that the system can quickly skim every single order and then summarize them correctly by day, into the respective General Ledger Accounts in your accounting system. Deposits will exactly match what your bank shows, and reconciliation from each day’s sales to the deposits, is automatic.

The best news is that this is all done magically while you sleep, and time zones are not an issue for ecommerce and retail automation software like Bookkeep.