Shopify users who sell via Facebook, Instagram, or TikTok need to be especially careful when filing their sales tax returns to avoid overpayment.

This is because these marketplace platforms are bound by the marketplace facilitator tax laws to withhold the sales tax, and remit it on the seller’s behalf. However, Shopify does not always call out the sales tax that was withheld by marketplaces in their standard reporting. So, you need to watch for it, and manually back it out of the sales tax figures provided by Shopify when you are calculating and remitting your sales tax returns.

Why does this happen?

Shopify Financial Summary Reports show gross Sales Tax, across all orders and channels, which can be misleading if used as the basis for filing the sales tax returns.

It can also get confusing if you are using Shopify’s Summary Financial Reports to book the journal entries to your accounting system – because your sales tax liability can be overstated by the amount of the sales tax the selling channels (like Meta) withheld.

In the basic Financial Summary, Shopify displays the total amount of Sales Tax, across all sales (including the sales taxes that were withheld by a selling platform), but they don’t show withholdings in the sales tax amount.

This means you are at risk of overpaying your sales tax unless you are careful to manually back out the amounts that Meta (and other platforms) withhold and remit on your behalf when you complete and file your sales tax returns.

Where to find this information in Shopify

The best way to find what you really owe, per state, is to run a customer report under this URL: https://admin.shopify.com/store/[my-store]/reports

→

→

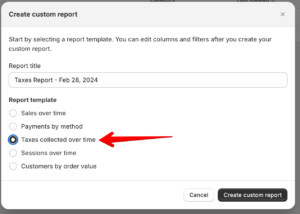

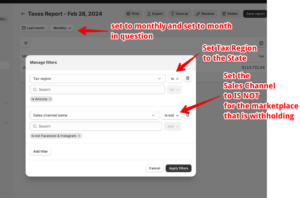

Then set your filters to as shown below:

You can also click on the Transaction Detail report to see the breakdown, and this will show the sales tax handled by channel, including the payments received per order. This can be useful if there have also been platform coupons used in any of the transactions.

In the image below, order number 1721542 (highlighted in green) has two things going on. The first is that the customer used a Meta coupon on the order (see the adjustment for $10.32 added from Meta to your payout from Shopify), and the second is that $5.65 is adjusted (subtracted from your Shopify payout) for sales tax withheld.

A similar situation is shown with order number 172536 (highlighted in yellow).

The Meta coupons end up in “Manual Payments” in the Shopify Financial reports, just in case you are wondering. But that’s an adventure we will cover in another article!

When you look at the Notes for order number 1724542 you see this:

Bottom line – Shopify Summary Reports can be deceiving, so be sure to understand where to look to ensure you don’t overpay your Sales Tax liability!

*************************

Explore Bookkeep’s Shopify Accounting Automation Software

Shopify bookkeeping just got easier. If you’re looking for an easier way to manage multi-channel selling complexities like this, the team at Bookkeep has you covered.

In Bookkeep, the Shopify Daily Sales Summary entries show 2 lines for Sales Tax.

- The first is for Sales Tax Collected

- The second is for Sales Tax Withheld.

The net between the two will hit your sales tax liability account in your accounting system. The sales tax reports by State and City are also accurate in Bookkeep.

You will minimize your risk of overpaying your sales tax if you use Bookkeep to manage your Shopify to QuickBooks, Shopify to Xero, or Shopify to Zoho Books integration.