Companies that sell on both Shopify and Amazon may inadvertently have an issue with the way their revenue is booked. This is because the two platforms use different methods to report revenue.

In a prior article (The Challenge That Shopify Reports Can Create for Accurate Revenue Recognition), we explained how the revenue reported on the Shopify Summary Financials report is based on when the order is placed. Since ecommerce and retail companies typically take the payment at the same time the order is placed, this means that reporting revenue based on order date is reporting revenue on the Cash Basis.

If the company only uses Shopify, with or without other platforms like Point of Sale Systems (which usually are on the Cash Basis for reporting purposes), then the methods of recognizing revenue across each platform will be consistent. Cash Basis may not be the right method for the company overall, but at least the method of recording revenue is consistent across selling platforms.

Where it gets sticky is if that same company ALSO sells on Amazon.

This is because Amazon reports recognize revenue based on the date the products are shipped (the Accrual Method), in contrast to Shopify reports that base the revenue on order date (the Cash Basis Method).

This means that any company that uses the Shopify Financial Summary data to book their revenue, and the Amazon reports to book that channel’s revenue, will have mixed revenue recognition methods across the two channels – one by Order Date/Cash Basis (Shopify) and one by Ship Date/Accrual Method (Amazon). YIKES.

What can be done about this?

If you are a business owner and you are booking your revenue to your accounting system, using the standard Shopify and Amazon summary financial reports, we recommend you talk to your accountant or bookkeeper to flag up the issue and take corrective action.

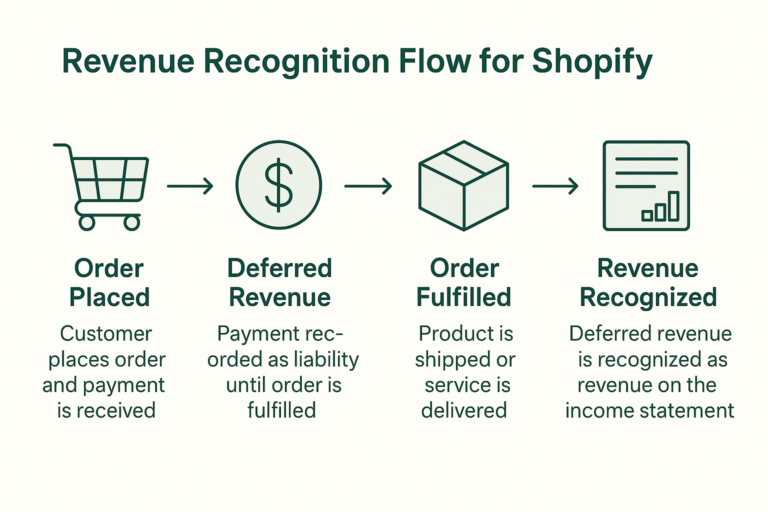

If you are an accountant, bookkeeper, controller, or CFO, we recommend that you talk to the folks at Bookkeep. Bookkeep has a feature (available in the Plus Plan and above) whereby Shopify financial data can be automatically recognized based on Ship Date. This moves the Shopify reporting to the Accrual Method and allows for proper Revenue Recognition, including deferring any revenue for products that have not been shipped yet. When a product ships, the revenue is moved out of deferred revenue, and into revenue. Learn more about Bookkeep’s revenue recognition feature for Shopify here.

Discover Bookkeep’s Amazon Seller Accounting Automation Software

Optimize your Amazon Seller bookkeeping with Bookkeep’s Amazon Seller to QuickBooks, Amazon Seller to Xero, and Amazon Seller to Zoho Books integrations.

Book a demo or contact sales below and streamline your Amazon and Shopify revenue accounting practices.