For ecommerce and retail brands, managing sales tax isn’t just tedious—it’s a growing liability. With sales across multiple states, platforms, and tax jurisdictions, staying compliant has become a full-time job. If you’re still managing tax data manually, you’re risking errors, missed deadlines, and audit exposure.

Enter accounting automation—a smarter way to manage sales tax without the chaos.

The Modern Sales Tax Challenge

Selling on platforms like Shopify, Amazon, Etsy, and Square means navigating a maze of rules: marketplace facilitator laws, state-specific nexus thresholds, digital goods exemptions—the list goes on. And every transaction carries sales tax implications.

Without automation, your team is forced to download reports, reconcile line items, and manually calculate tax liabilities. It’s time-consuming, error-prone, and ultimately unsustainable.

How Accounting Automation Solves the Problem

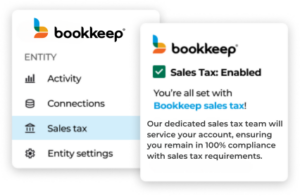

Accounting automation tools connect your sales channels directly to your accounting system and reconcile your financial data daily. But beyond clean books, these tools create a solid foundation for automated sales tax compliance.

Here’s how:

-

Daily, Accurate Tax Tracking

Automation ensures your tax data is posted consistently—no more chasing down reports or correcting entries at the last minute. -

Seamless Multi-Channel Integration

Sales tax data from Shopify, Amazon, Square, and others can be unified and categorized correctly across platforms. -

Real-Time Sales Tax Visibility

Get clear insight into how much you owe, by jurisdiction, so you’re never surprised at filing time. -

Audit-Ready Records

Automated entries provide a clean, consistent audit trail—making audits less painful and more predictable. -

Effortless Scalability

Whether you’re adding new channels or expanding into new states, your tax tracking scales with your business automatically.

Automation Enables Confident Compliance

By automating accounting and sales tax workflows, brands reduce risk and free up time to focus on growth—not government forms. Many tools also integrate directly with tax filing solutions, so once your data is flowing cleanly, filings can happen in just a few clicks—or even automatically.

Accounting automation isn’t just about saving time—it’s about protecting your brand and preparing for scale. If you’re looking to future-proof your operations and breathe easier at tax time, automating your sales tax data is the move.