How to Manually Book Shopify Sales and Deposits

Manually recording Shopify sales and deposits in QuickBooks can be tricky — especially when locating the right reports. This guide walks you through where to find your Shopify data and how to accurately book your daily sales, liabilities, and payouts in QuickBooks.

Step 1: Find and Run Reports in Shopify

The key report you’ll need is your Finance Report, located in your Shopify admin under:

Analytics → Reports → Finances Summary

You can also bookmark the direct link below (replace “YOURSTORE” with your store domain): https://YOURSTORE.myshopify.com/admin/analytics/reports/finance_summary

Bookkeep recommends booking sales daily, not weekly or monthly.

Daily booking helps you catch mistakes early — for example, if you book sales under the “Manual” payment type but forget to collect payment, you’ll spot it the next day instead of weeks later when it’s harder to fix.

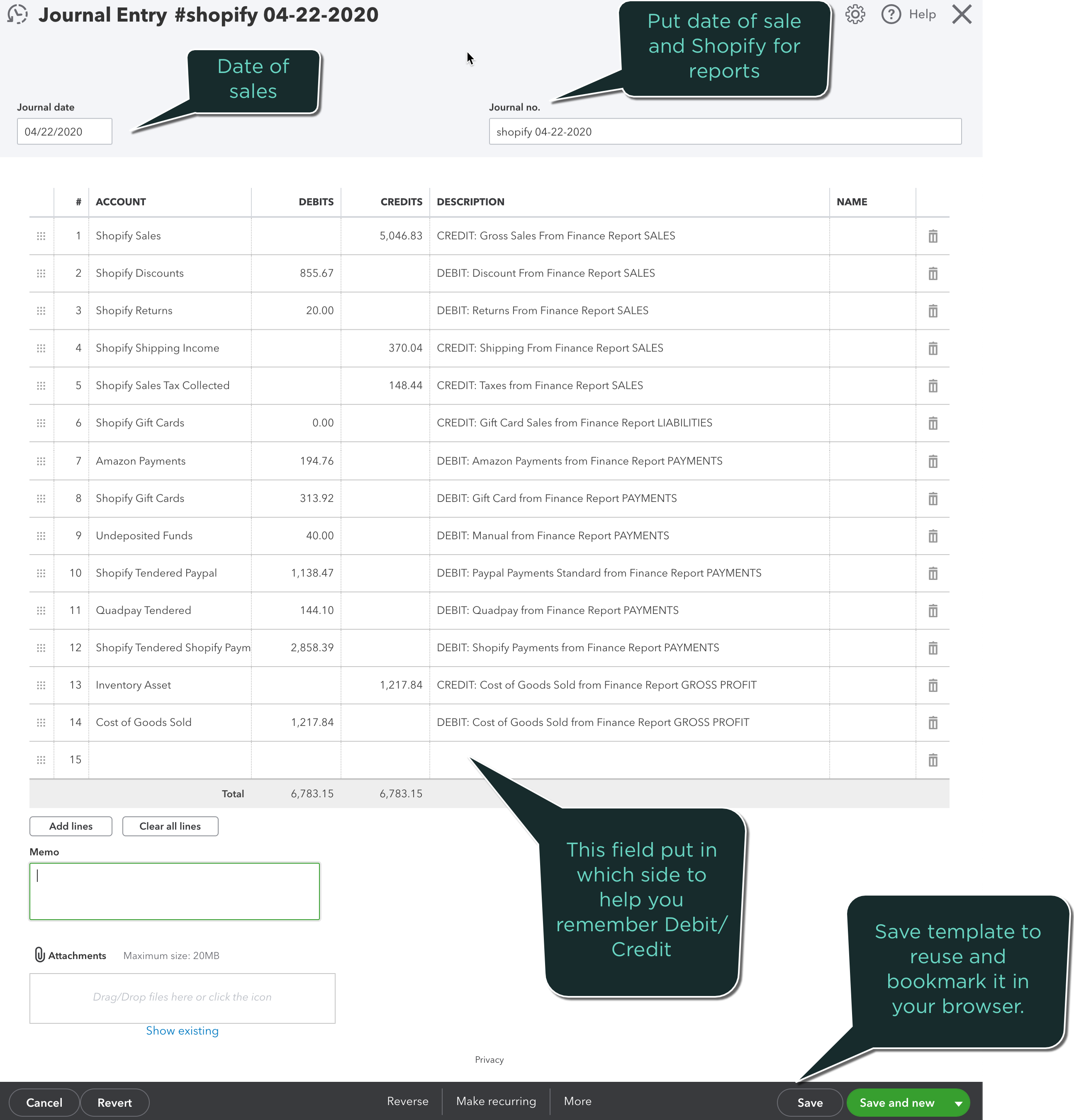

Step 2: Book Your Sales in QuickBooks

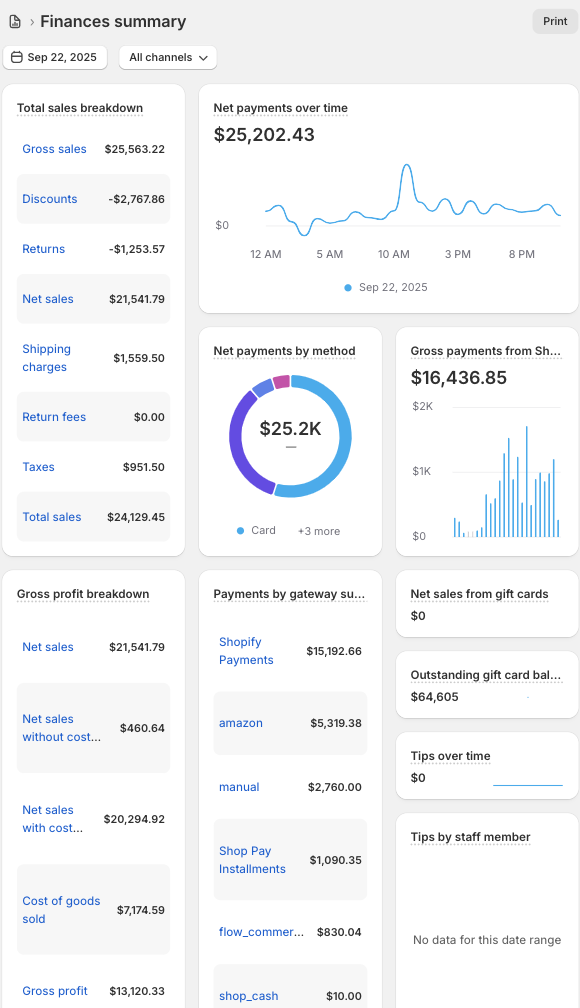

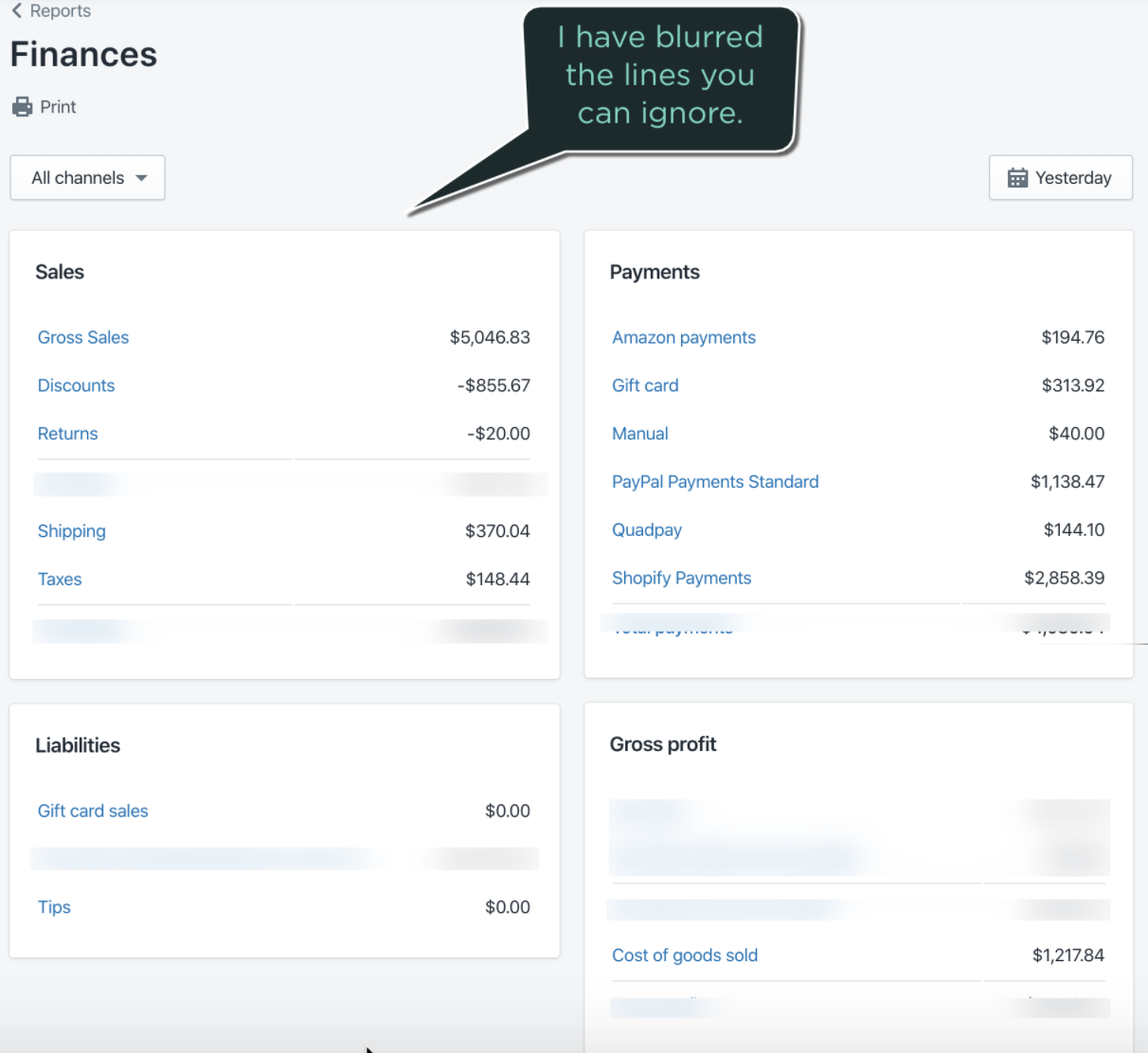

1. Run Finance Report in Shopify��

In Shopify, run your finance report for a single day similar to the image shown below where September 22 is selected.

2. Create Recurring Journal Entry in QuickBooks

Head over to your QuickBooks to create a recurring Journal Entry.

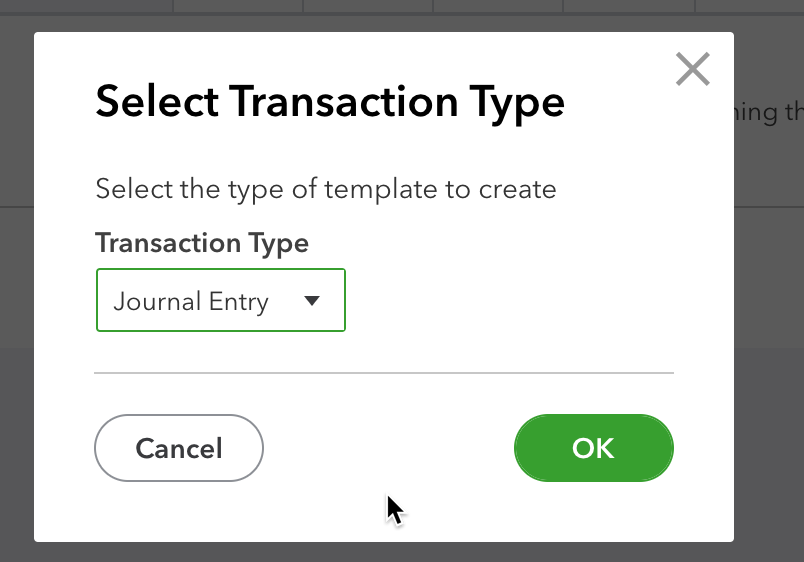

3. Create New Journal Entry

Click "NEW" and then choose Journal Entry as the transaction type as shown below:

4. Name and Set the Template

Give the template a clear name such as “Shopify Sales” and set the schedule to Unscheduled so you can reuse it manually each day.

5. Map Accounts

Set up your accounts to map to the report above. Map each line of your Shopify Finance Report to the appropriate QuickBooks accounts.

For example:

-

Sales → Income: Shopify Sales

-

Discounts → Contra Income: Discounts Given

-

Shipping Income → Income: Shipping Revenue

-

Sales Tax → Liability: Sales Tax Payable

6. Select Report Lines

You only need the relevant summary lines from your Shopify Finance Summary (these may vary by store). Common ones include:

-

Gross Sales

-

Discounts

-

Returns

-

Shipping charges

-

Return fees

-

Taxes

-

Net sales from gift cards (does not include manually issued gift cards and does not include discounted gift cards)

-

Payments by gateway (e.g., Shopify Payments, PayPal, Manual, etc.)

-

Cost of Goods Sold

-

Tips

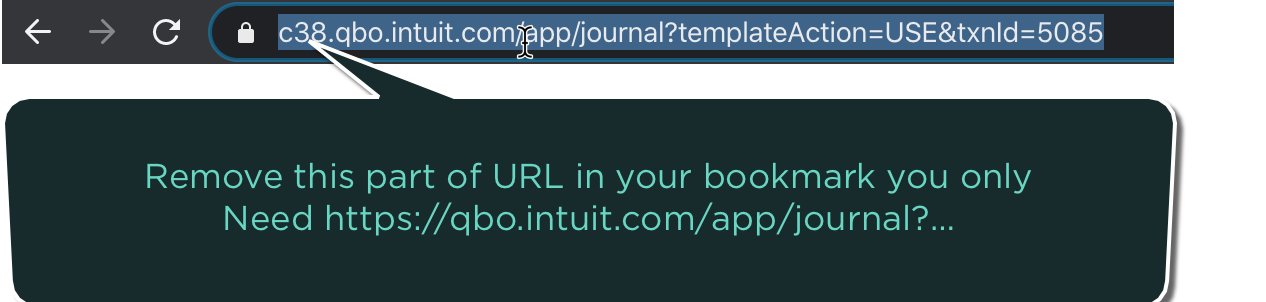

7. Create and Save the Template

Build your template in QuickBooks using the mapped accounts above. Save and bookmark it for easy access.

When bookmarking, remove everything in the URL before “qbo” (for example, remove c38 in your link):

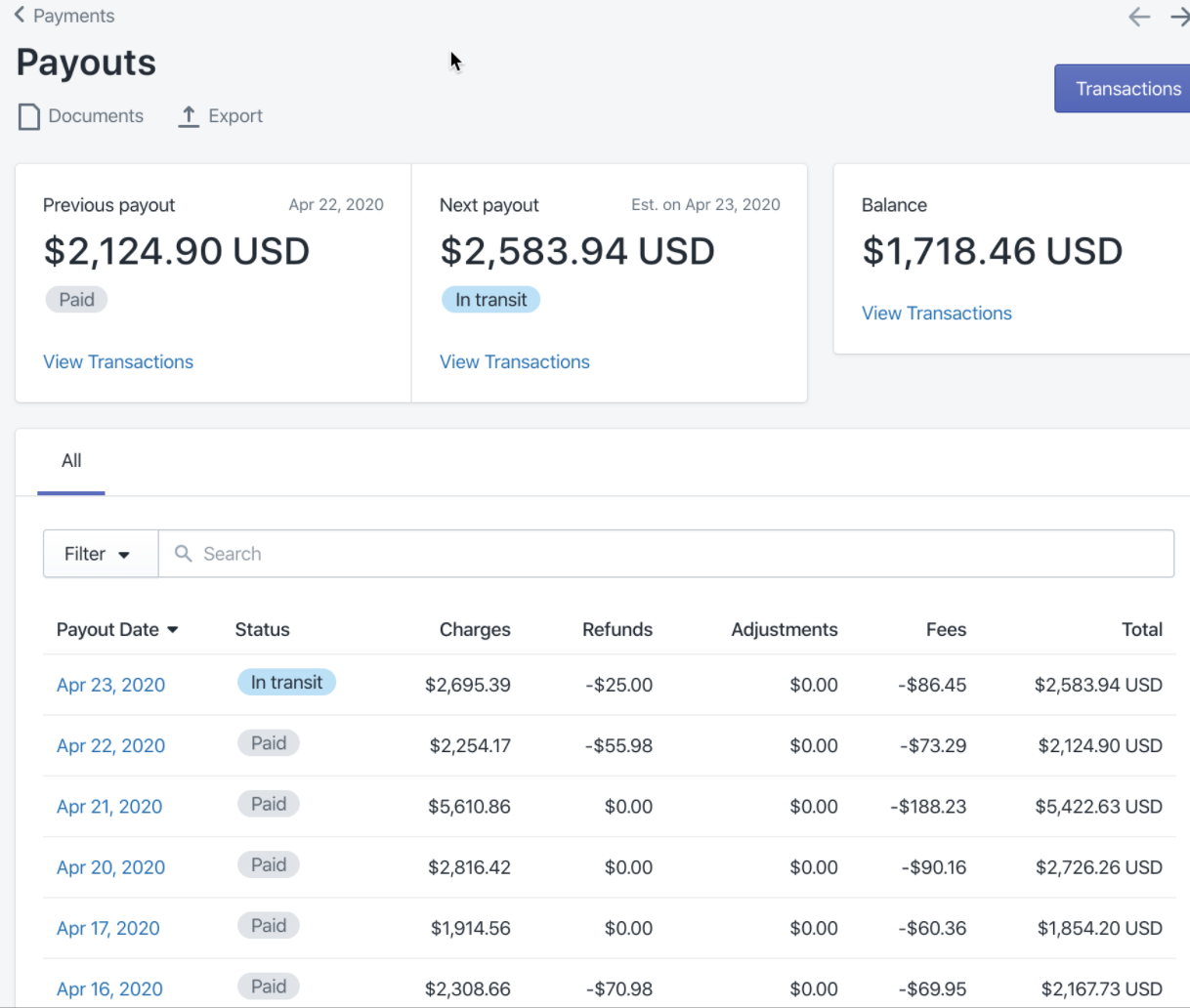

Step 3: Book Deposits to QuickBooks

Important: Shopify deposits are not pure sales.

Each deposit includes a mix of sales, tips, taxes, refunds, and fees, so posting them directly as sales will throw off your books.

To find deposits, go to Finance -> Payouts or bookmark this direct link (replace “YOURSTORE” with your store domain):

https://YOURSTORE.myshopify.com/admin/payments/payouts

Book each day’s payout separately so it matches exactly with your QuickBooks banking feed. Here is what the Payout view looks like:

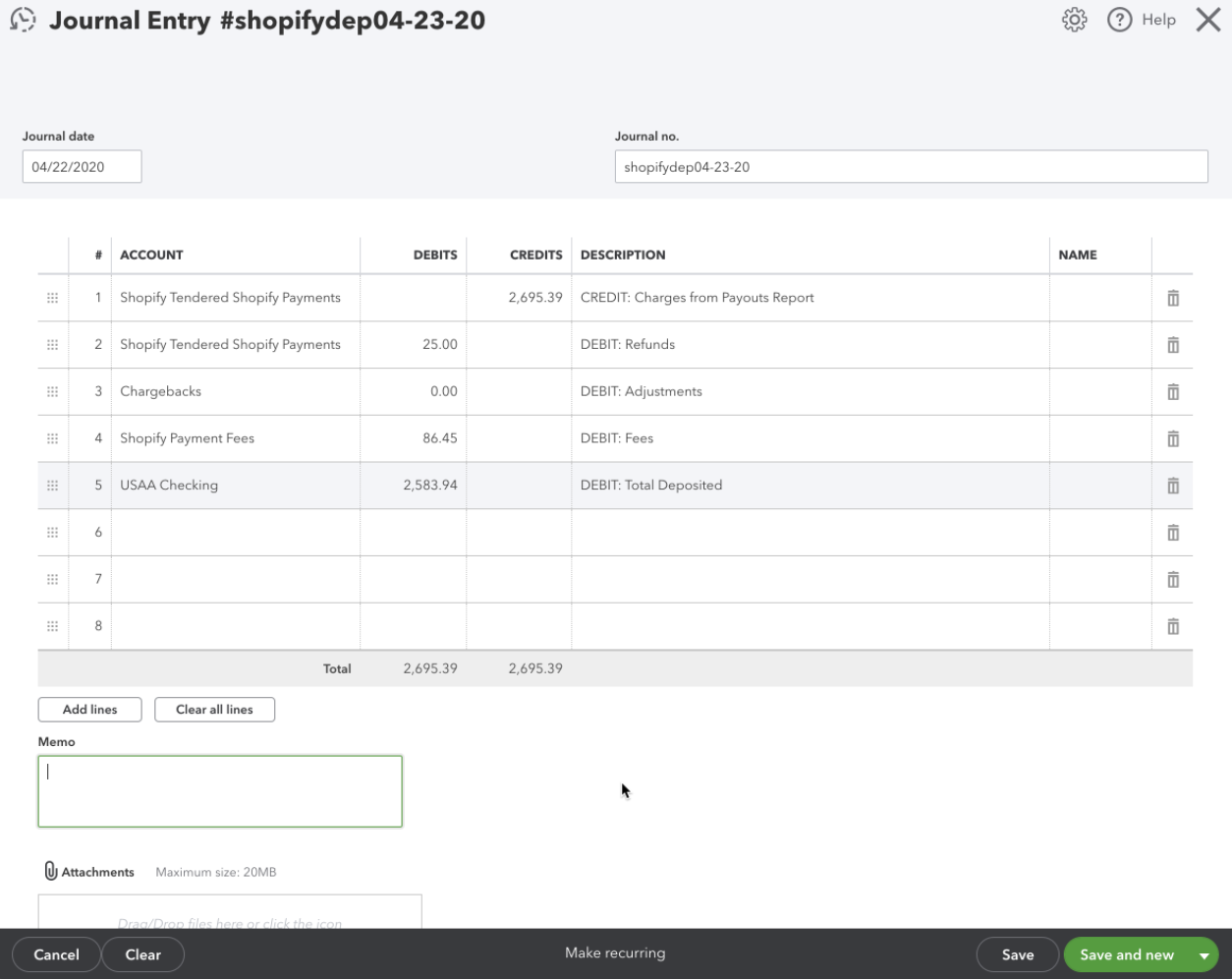

1. Create a Deposit Template

Create a new Template in QuickBooks under recurring transactions and use type Journal Entry.

2. Set Up the Deposit Template

Your deposit journal should look similar to this example in the image below:

-

Credit: Shopify Payments Clearing Account

-

Debit: Bank Account (for deposit amount)

-

Debit/Credit Adjustments: For fees, refunds, or chargebacks as needed

This ensures each deposit reconciles perfectly with your bank transactions.

Step 4: Keep It Consistent — Or Automate It

By following this workflow, you’ll have clean, daily Shopify summaries in QuickBooks that reconcile easily with your deposits.

Show this process to your bookkeeper or accountant so they can consistently record your sales and payouts.

If you’d rather automate this process, Bookkeep can handle it for you — posting accurate daily summaries and reconciling your books automatically every month.